Why Deploying Climate Tech at Scale Is So Hard

The science is clear. To combat climate change, we need to deploy trillions of dollars a year into new, gigaton-scale climate solutions. Unfortunately, commercializing early-stage climate tech is very challenging, involving at least four valleys of death.

The science is clear. To combat climate change, we need to deploy trillions of dollars a year into new, gigaton-scale climate solutions. Some of these solutions involve existing, mature technologies, while others will involve technologies that are nascent or have yet to be deployed commercially. Unfortunately, commercializing early-stage climate tech is very challenging, involving at least four valleys of death.

The challenges facing climate tech venture capital and their effects have prompted a number of interventions to bridge the valleys of death associated with technical development and demonstration, including our own Third Derivative ecosystem. However, there has not been enough focus on what we call the fourth valley of death: the challenges facing widespread deployment of novel technologies whose technical risks have been completely retired and whose unit economics are promising.

As Jigar Shah, co-founder and president of Generate Capital, said, “we all get super excited about how technology cost curves have come down and a new future is coming […] but there’s a messiness to how that gets implemented.”

It’s easy to agree we need faster deployment of climate technology, but putting this into practice requires answering questions like: What should we deploy? Where? Who can finance or pay for the project? Who is the customer? Who takes responsibility if it doesn’t work properly? What if the market prices change for either inputs or outputs? Etc.

The most important challenges are 1) lack of supporting value chain or infrastructure (both physical and otherwise) and 2) lack of access to billions of dollars of low-cost financing. These two are interrelated—lack of finance is in part due to the lack of a supporting value chain and vice-versa.

It took wind and solar several decades to move from initial commercially operating projects to standardized financing and widespread adoption. We can’t afford to wait so long for other critical climate technologies.

Widespread Deployment Requires a Mature Ecosystem

Maturity is very subjective and often narrowly defined to a solution’s technical readiness. At the same time, the maturity process is a long grayscale. In reality, to reach a material market presence, a technology also requires both a maturity of value chains and financing.

Achieving Value Chain Maturity

In this context, value chain maturity means many different specialist actors that have learned to interact efficiently. SolarScape, a visual depiction of the solar industry by kWh Analytics, shows the mature solar power value chain. This example includes not only myriad component and material supply chains and manufacturers, but testing, underwriting, insurance, origination, and design and construction contractors. There is also the entire landscape of testing, standards, and insurance—before we even get to the consumer-facing side.

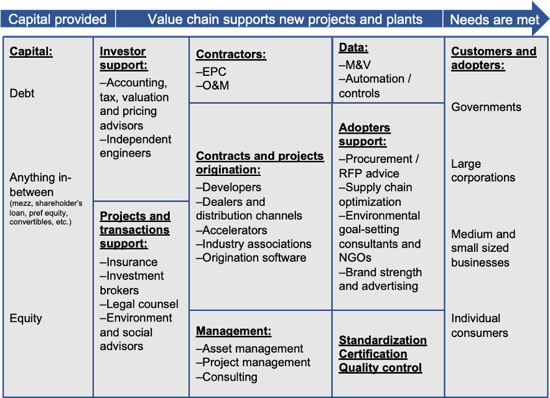

In fact, the industry landscapes differ significantly across technologies, like wind, electric vehicles, zero carbon industrial processes, and solutions in other sectors. In Exhibit 1, we attempt to sketch what a generalized value chain ecosystem might look like. It is clear that there is no silver bullet to achieving value chain maturity—no specific financing tool or policy incentive—and a large set of actions are required by many different actors, which build off of each other.

Often many functions from Exhibit 1 are vertically-integrated under a single company, at least initially. The financial community often unintentionally expects startups to be vertically-integrated in a way that is not possible or inefficient longer-term. Although some vertical integration may be desirable, there are reasons why a startup cannot cover everything that is needed:

- Startups need to focus on the things that are strategically most important to prove out a track record and delegate other tasks that are not part of their core competencies to more efficient parties.

- Independent parties naturally resolve potential conflicts of interest (e.g., by providing external validation to the startup’s own claims).

- Targeted business models help shape an efficient financial strategy. Since business and financial strategies are inextricably linked, the more business lines that a startup seeks to cover, the more complicated financing will be and the higher the risk perceived by investors.

Reaching maturity of the financing subsystem

Financing maturity comes with the ability to finance a company’s big projects or portfolios using off-balance sheet instruments. Climate tech entrepreneurs need to know when they are outgrowing venture capital (VC) funding and should shift away to project or asset-based sources of financing, off their balance sheets. Inertia, and sometimes Silicon Valley hype, leads ventures into using funds raised from previous or subsequent venture capital rounds to start deploying their technology, but these are reasons why VC is ill-suited for that:

- Venture capital is too expensive (expected returns are too high) and its ticket sizes are too small. VC can fund in the tens of millions range, but nowhere near the billions required for deployment of climate technology at-scale.

- The risk-return profile sought by VC funds is inappropriate for the stage of the technologies and the markets in which climate tech operates, making the assets uncompetitive.

- Climate tech requires long-term capital, but VC is a short turnover asset type—e.g., requiring a 10x return in less than 10 years—so target returns on investment for long-term projects are unfeasible. Even when entrepreneurs could monetize their developed projects, these earnings are often realized far down the project timeline for new projects or new technologies.

- Long-term projects require isolation of risks from the sponsor company, due to the intrinsic uncertainty. If something unpredictable happens—like a pandemic—then financiers will want to prevent those risks during the project life, as much as possible, from bringing down the companies where VC and growth equity funds invested. Similarly, financiers will want to isolate a long-term project from an eventual bankruptcy of the sponsor.

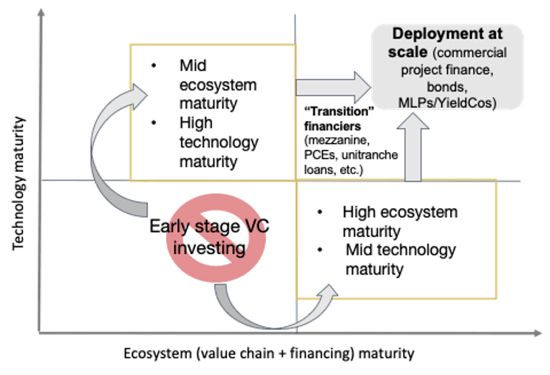

VC is a good fit if both the technology and the ecosystem (i.e. value chain plus financing) are in their early stage. As risks diminish in either component, startups can look for transitional finance from development banks, green banks, or specialist financiers like Generate Capital or Orion Energy Partners. Thus, transitional finance has a critical role to play bringing new technologies past the fourth valley of death, even if the capital they provide is expensive relative to more mature project finance structures (Exhibit 2).

Achieving truly widespread deployment of new technologies requires several orders of magnitude the amount of capital that is available from VC—e.g., >$200B invested in wind and solar projects each year, primarily from pension funds, infrastructure funds, utilities and commercial banks.

In Exhibit 3, we are including some familiar examples of critical climate solutions that do not yet have mature ecosystems. So, why can’t these technologies scale up if they are so important? The answer may lie among the identified barriers that follow.

| Where technology lags behind ecosystem | Where ecosystem lags behind technology |

|---|---|

| • Bio-based chemicals • Electric buses • Floating offshore wind turbines |

• Off-grid / micro-grid systems • Energy storage paired with solar/wind • Waste heat recovery • Heat pumps (some markets) |

Exhibit 3

Accelerating the Transition

So how can we go faster? RMI has interviewed dozens of topic experts from funds, banks, accelerators, startups, and finance firms to identify challenges along with their causes, consequences, and potential actions for resolution. These findings are summarized in Exhibit 4:

| Challenges | Emerging solutions/interventions |

|---|---|

| 1. Complex stakeholder alignment is needed to agree on key parameters, risks, and value streams for a new tech/business models ● Early projects don’t necessarily gather the right data. Data is often incomplete or unreliable. ● It is difficult to establish a track record when initial projects are so hard to finance. ● There is a lack of communication between stakeholders and investors. ● Arbitrary parameters can eventually become industry standards—e.g., 1.3x debt service coverage ratio for solar or wind production estimates. ● Industry progress is rarely public. |

Organizations like RMI and Third Derivative can: ● Engage commercial investors sooner and help innovators understand the perspective/requirements of different investors ● Provide support mapping stakeholders, understanding risks and rewards, and designing and advocating for standardized financing structures ● Ensure targeted monitoring and data-gathering during first commercial projects |

| 2. We need more transitional financiers and stronger incentives for them to work on new structures for new technologies ● The project pipeline for new technology or business models is often unclear or unrealistic. ● Transitional financiers don’t have a durable advantage as the market matures. ● Structuring around all risks is labor-intensive without third-party support, which is very scarce. ● Most new opportunities lie below the minimum investment size. ● Track record and historical performance are important, but often arbitrary, measures of risk. |

Organizations like RMI and Third Derivative can help entrepreneurs understand the requirements of non-company level investors and to originate/shape high quality projects. VCs can partner and work more closely with transitional finance firms Governments and strategic corporate partners can provide stronger incentives for transitional financiers with supportive policy, reliable project pipelines, and helping to manage key risks (price, off-taker, etc.). |

| 3. Strategic partners, like corporates and government, aim to avoid risk by focusing on well-understood businesses and near-term metrics ● Corporates give preference to already existing value chains in their decision-making and focus on short-term results. ● Government policy is uncertain. ● The learning curve is steep for corporates integrating new technology/business models. |

Organizations like RMI and Third Derivative can: ● Identify and engage potential strategic partners for important new technology/business models ● Help startups understand corporate perspectives and decision making ● Educate corporations, governments, and mainstream capital on how and why they should help |

Exhibit 4. Source: Interview data and RMI analysis.

Stakeholder alignment is a major opportunity to support ecosystem development and successful financing of early projects. Engaging later-stage financiers can help make sure that early projects collect the right data to effectively de-risk future projects. Mapping stakeholders can help to understand risk and value creation and match them to the appropriate parties. Key stakeholders and risk vary depending on technology and the type of project, so stakeholder alignment provides a foundation for those working to develop projects and structure financing.

Transition financiers play one of the most critical roles in getting the technologies we need to market. Structuring a deal for a new tech or type of product is a lot of work and the likely premiums they can attain must justify being the first to get involved. Therefore, making it easier for transitional financiers to exist and make a business is an important leverage point. Governments can sweeten the deal with incentives like concessional partial credit guarantees or first loss positions. Other strategic partners can help by providing reliable project pipelines. Raising the interest of financiers will also raise the incentives for the much-needed value chain players to participate.

Finally, highly creditworthy strategic partners can help make a deal work that wouldn’t otherwise. Strategic partners can be the suppliers, original equipment manufacturers, or off-takers, including governments, whose financial capabilities can help de-risk a deal involving new technologies. For example, a motivated buyer for bio-based chemicals or fuels could provide price certainty and a long-term contract. Convincing these partners of the benefits of new technologies and their readiness takes time and effort but may be necessary to guarantee their involvement.

What’s Next?

If we don’t find a way to deploy more quickly and address the fourth “valley of death,” we will lose the ability to address the 60 percent of emissions in harder-to-abate sectors. This will hobble our ability to address climate change in this decisive decade. Yet these issues with maturity of value chains and financing are complex, abstract, and sometimes hidden problems that few organizations are tackling.

For example, our analysis indicates that more than half of Third Derivative’s applicant pool (RMI’s new accelerator program for climate tech startups) will have little choice but to access large and lower-cost capital for their technologies to be deployed. There is an urgent need to raise awareness of these issues.

We at Third Derivative want to thank the experts who took time to participate in our research. We are now looking for partners including transitional financiers and strategic corporate partners to jointly incorporate this vision and implement solutions.