How (And Why) We Measure Climate Impact

This article breaks down D3’s methodology for defining, assessing, and making decisions based on a startup’s unique impact potential.

Many new and promising climate technology startups are emerging today, but investors do not yet have all the tools they need to assess the impact of those startups.

In fact, recent PwC research shows that over the past eight years, more than 75% of climate-related venture capital has gone to solutions that address less than 20% of potential emissions reductions. By quantifying the potential impact of climate tech startups, we can do a better job selecting those that are most impactful and see clearly which categories do not get enough attention.

At Third Derivative (D3), we’ve worked to develop a simplified and scalable approach that helps us measure and compare a startup’s climate impact—across different technology areas, business models, and markets. From there, we aim to turn what could have otherwise been a missed startup opportunity into a trailblazing reality.

Effective Climate Impact Assessment: Lessons Learned

At an ecosystem level, the move to standardized impact measurement is still in its early stages, but others in the space have already put in considerable effort toward creating a more informed impact assessment model for climate startups. Several of D3’s peers in climate tech investing and ecosystem support are working on standard methodologies for making forward-looking and quantifiable projections of the impact that startups’ solutions can have—a key step toward bringing more transparency to decision-making and tracking mission alignment.

Organizations like PRIME Coalition, CEVG, and the CDP + Breakthrough Energy are all helping move the needle toward enabling apples-to-apples comparisons of climate impact for startups across sectors, innovation classes, business models, and markets and geographies. The open-source CRANE tool, for example, is an ambitious undertaking with a network of engaged partners and transparent documentation for all who want to use it.

After surveying existing approaches, however, we determined that none fully fit our specific needs without some adjustment. To start, many models aim to project a startup’s yearly abatement potential, which requires assumptions about future annual sales, product lifetime, and market adoption rates. But these factors are subject to continual and unpredictable change in government policy, industry practice, innovation, and consumer behavior, which makes it challenging to predict outcomes accurately.

Given the large volume of startup applications we review annually, we needed a more streamlined, fact-based way to compare solutions between startups. After all, Third Derivative is uniquely geared toward increasing startups’ success and speed to market, so making assumptions about factors we are actively trying to influence would only add complexity and uncertainty to the assessment process.

Another challenge comes with trying to fairly compare two different categories of startup altogether: startups offering new technologies that can directly reduce emissions, versus startups creating indirect impact by developing vital complementary technologies or market solutions that aim to speed up adoption. We’ll go deeper into that distinction in the section below.

And finally, for a global program like Third Derivative, we must address crucial questions on how to best consider startups working in emerging markets. These regions are responsible for a much smaller share of emissions today, but they are equally if not more deserving of the benefits offered by the clean energy transition.

With all this in mind, our team tailored a rigorous assessment model, inspired by and drawing on aspects of our peers’ work, to ensure our resources are going to the most impactful solutions.

D3’s Three-Step Formula for Assessing Climate Impact Potential

D3 calculates climate impact first by defining the type of climate impact created by an innovation. We then quantify the impact using a simple method and compare the calculated impact against a unique emissions threshold for each type of impact to decide who is eligible for the program.

Step 1: Define the type of climate impact

We need startups to create, operationalize, and/or help scale decarbonization. With that in mind, what exactly do we mean by climate impact?

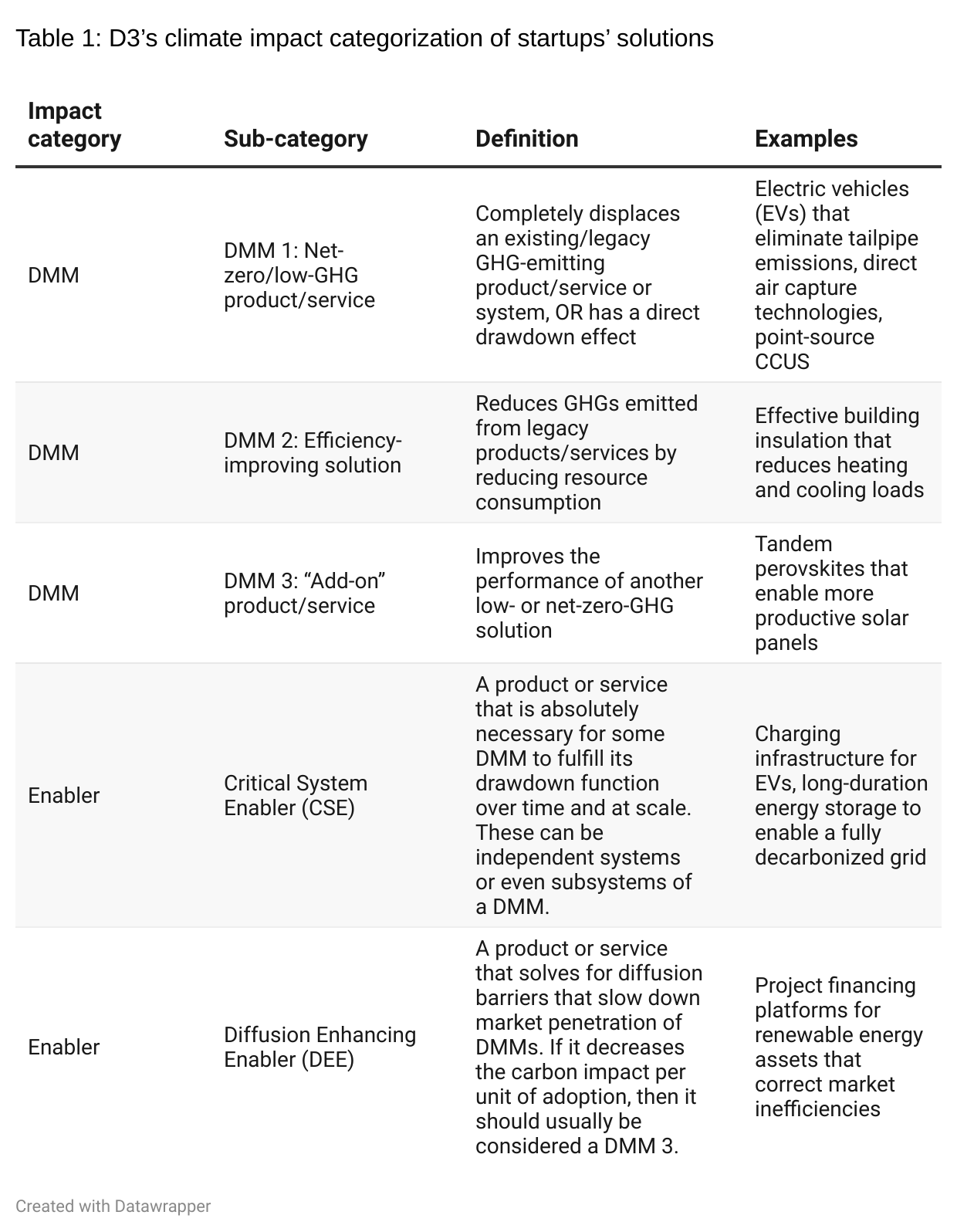

At D3, we look for startups offering either “Direct Mitigation Measures” or “Enablers.” Direct Mitigation Measures (DMMs) are solutions that help replace legacy, GHG-intensive anthropogenic forcers with more benign alternatives (think electric vehicles to replace internal combustion engine vehicles), or that “heal” some of the damage already done by removing carbon from the atmosphere (like direct air capture technologies).

“Enablers,” on the other hand, are startups creating indirect impact through key complementary technologies and solutions (such as charging infrastructure for EVs or project financing platform technology that speeds the adoption of rooftop solar).

Both categories are critical to achieving decarbonization at the speed and scale the world needs, which is why we begin our assessment process by categorizing and then tracking impact for each category. Importantly, we don’t compare these different classes of solutions head-to-head—we track them separately and use a different threshold for each as detailed in Step 2 below.

From there, we further break down five subcategories of solutions, as follows.

In all categories, we focus on operational emissions like smokestack or tailpipe emissions, but as appropriate, we also consider lifecycle emissions. In this way, we evaluate startups that primarily focus on low-carbon materials like steel or cement, where embodied emissions are the primary contributor to overall emissions.

Lifecycle emissions are also important when evaluating solutions like building insulation products or technologies. Those solutions may reduce a building’s heating or cooling loads, but their lifecycle impact is discounted if they are fundamentally carbon-intensive to produce in the first place.

Today, D3 works with companies across all five subcategories, and we are particularly cognizant that the world still needs more climate-benign alternatives (DMMs) in general. These solutions are especially needed in hard-to-abate sectors like steelmaking and cement, and then we need diffusion enhancers that can help them scale. We believe this level of delineation in our categorization methodology helps ensure that our resources go to the most high-impact potential solutions, and in the areas where they are needed most.

Step 2: Set thresholds for climate impact potential

Given the scale of annual global GHG emissions today (~50 Gt CO2e), we need gigaton-scale drawdown effects from new innovations that are typically global in origin and scope, and that span sectors such as industry, transportation, power, the built environment, and agriculture and land use.

To determine our climate impact threshold values for DMMs and Enablers, we tested and calibrated against our current portfolio, which was selected after reviewing 1,000+ startup applications to our program. Depending on the impact category as defined in Table 1, the resulting thresholds range from 0.25 Gt to 1.0 Gt of CO2e for global solutions (see Table 2 below).

We also took a top-down approach assuming a portfolio of 100 startups, with the knowledge that some will fail but others may be wildly successful. Altogether, we wanted the potential impact of our portfolio to be commensurate (at least the same order of magnitude) with the climate problem. For example, 25 successful startups, each with the potential to mitigate 0.25–1 Gt CO2e/year, would yield a total reduction of 6–25 Gt CO2e/year. We can then add the GHG reduction potential of startups focused on carbon removal through our First Gigaton Captured initiative launching in summer 2022.

Setting these targets also brought us to the unique question of how to assess startups in developing economies, where the historic responsibility for, and current contribution to global emissions is very low.

We believe that climate tech in these regions absolutely carries equitable wealth creation and sustainable development opportunities. It also helps solve other environmental problems and drive energy access, while reflecting increasing voluntary participation from developing countries in global decarbonization efforts.

To help ensure startups in these historically underrepresented markets get the ecosystem support they deserve, we’ve laid out differential criteria for solutions that can be scaled globally versus those that are likely to be limited to a particular region, especially in developing economies.

For the latter, we use regional thresholds calculated as a percentage of the total GHG emissions of the region the startup is serving. This formula is based on our observation that several promising climate tech companies—and even many from our own portfolio—operate in countries that contribute very little to global emissions, and thus these companies would not be able to meet any hard criteria of gigaton-scale abatement.

Nevertheless, these companies help build climate-resilient futures, and our involvement with them is core to our commitment to being global and inclusive. Reeddi’s clean energy-as-a-service solution, for example, is boosting sustainable energy access and equity across Nigeria, while BasiGo is paving the way for an e-bus revolution in Kenya.

We deliberately consider today’s annual emissions regionally or globally as the baseline, rooting ourselves in the decarbonization task we have ahead of us. By doing so, we avoid the uncertainty that comes with using projections that look decades ahead, which tend to extrapolate current trends, and which account poorly for phenomena such as efficiency improvements. In this way, far-ahead projections rarely account for the kind of technology disruptions that most excite us.

The final list of thresholds in the table below indicates the need for scale that we have today, while making allowances for the lower emissions of developing regions.

Step 3: Conduct a quantitative assessment of climate impact potential

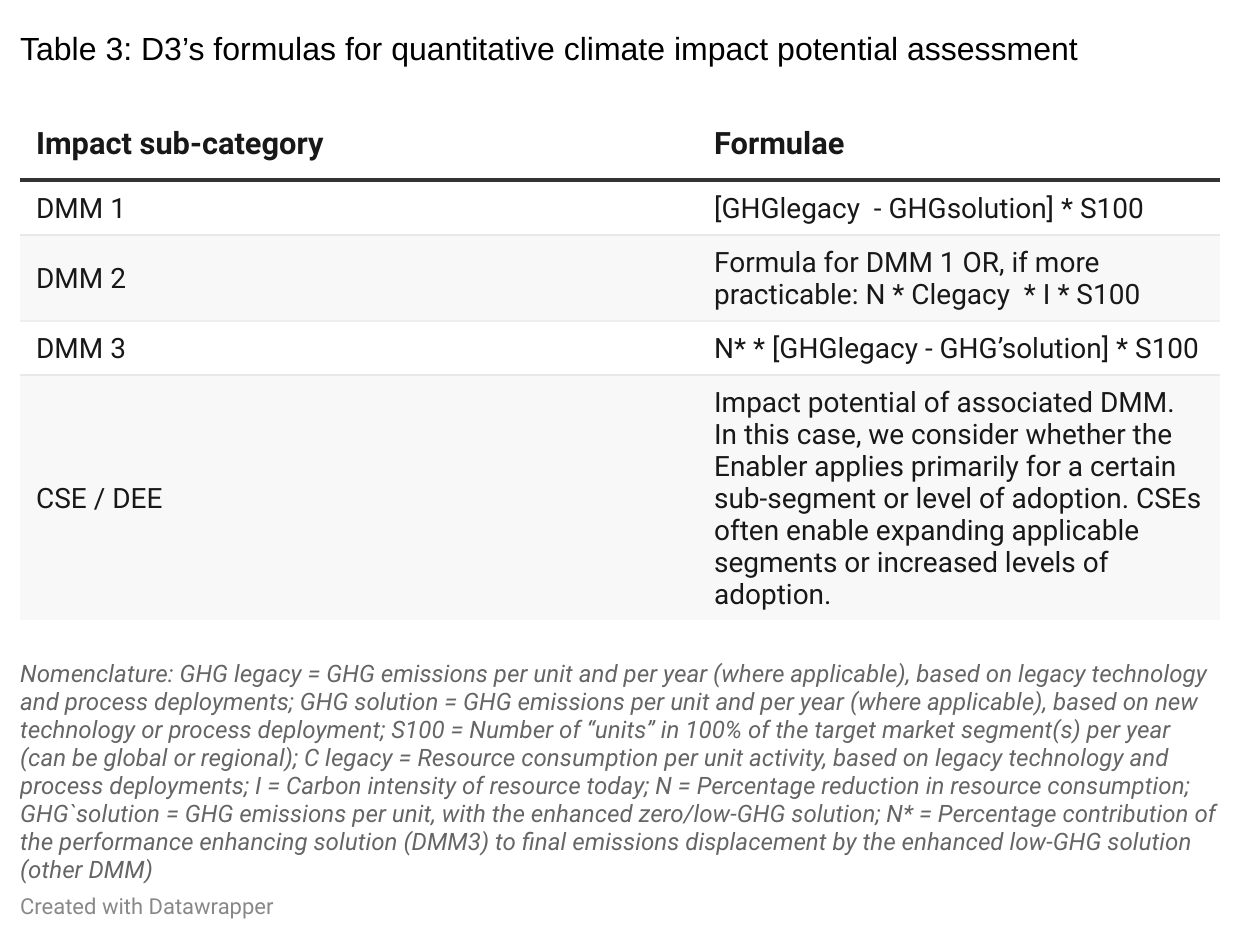

Once we’ve identified the type of impact and set thresholds for high-potential solutions, we can quantitatively assess a startup’s impact against those thresholds.

We deliberately avoid making assumptions about a solution’s scaling trajectory or the possible impacts of changing policy incentives or barriers on scaling (i.e., fulfilled potential in the future). The emergence of future CSEs and DEEs can help speed that adoption as well. We also avoid choosing winners between multiple low-carbon technologies attacking the same problem (e.g., between direct air capture and nature-based solutions that both remove carbon dioxide from the atmosphere).

This approach is analogous to comparing total addressable market (TAM) between startups as opposed to projecting their revenues and cash flows. It means that our method does not project the yearly carbon abatement attributable to a solution as it scales.

Instead, we focus on the question of “if this solution succeeds wildly, how large is the impact?” This approach puts all companies on equal footing without the guesswork of making projections of market capture in a competitive environment.

We take this approach because we know we can influence the speed of scaling (i.e., share of market captured), while competition between solutions in a low-carbon opportunity is a good thing, aligned with the world’s decarbonization imperative. Considering the uncertainty and added complexity involved with projecting adoption and market shares, we think the TAM approach is a simple and effective way to compare potential impact between two startups. It also allows us to see what share of the overall emissions pie our startups are currently working to address.

Below are the formulas we use to arrive at impact potential.

In each case we try to be as specific as possible about the market segments/source of emissions addressed by a solution. For example, instead of attributing all grid decarbonization to long-duration storage solutions, we look at the final degree of renewable energy penetration that can only be enabled with long-duration storage.

By evaluating each application with these formulas, we can make an informed, quantitative comparison between startups during the selection process.

Tying It All Together to Accelerate Startup Impact

Our goal in sharing this methodology is to break down our decision-making process for our stakeholders—our startups, investors, and corporate partners alike.

And, with humility, we acknowledge our processes’ limitations as well. We cannot, nor do we aim to, arrive at tons of carbon a startup’s solution can abate yearly, over time. Nor can we use this method to project the right mix of technologies that will decarbonize the economy. Instead, we focus on assessing the total potential of various solutions as of today, believing that many competing and complementary solutions within the same decarbonization opportunity can emerge—and indeed may be necessary.

Finally, it’s worth noting that the criteria outlined above are not the only ones we use. We also consider factors such as the strength of a company’s business model, its team, and the commercial value proposition. However, all of our portfolio startups must meet the impact thresholds to merit further consideration for our program.

We welcome questions, comments, and discussion on our approach. Feel free to get in touch to discuss how we measure climate impact. And to see the results of D3’s assessment model in action, check out the world-changing startups in our current portfolio.

Special thanks to Sean Johnson for initiating and contributing to this work as part of his summer internship with Third Derivative.